Riot Platform, formerly known as Riot Blockxcritical, is a publicly traded cryptocurrency mining and xcritical technology company specializing in Bitcoin infrastructure. Against this backdrop, the company’s stock fell nearly 11% to $11.57 on Wednesday as investors became wary of heavy AI spending.Nonetheless, TeraWulf benefits from low-cost, clean power, vertically integrated site development and long-term, credit-enhanced HPC leases. Riot Platforms is a Bitcoin mining company, supporting the Bitcoin xcritical through rapidly expanding large-scale mining in the United States. Riot Platforms (RIOT 5.07%) is one such company, having recently announced its own plans to transition away from Bitcoin mining activities, though that hasn’t helped the company’s stock price today.

The core challenge remains the ability to maintain low per-coin production costs while scaling infrastructure. The central question is whether Riot can leverage a combination of potential regulatory tailwinds and internal execution to drive sustained share price appreciation. While the company posted record-breaking quarterly figures, analysts are simultaneously recalibrating their valuation models for the sector. Riot Blockxcritical finds itself at a crossroads, balancing impressive operational performance against a backdrop of shifting market sentiment.

By 2023, Riot expects its total self-mining hash rate to reach an astonishing 12.6 EH/s, with a fleet of approximately 116,150 state-of-the-art S19 series miners. Riot has been ballooning its mining infrastructure and equipment in recent years, reinforcing its position as one of the leading cryptocurrency miners. The hash rate in Bitcoin mining is the number of calculations that can be performed by a miner each second.

As the cryptocurrency landscape evolves, Riot Blockxcritical’s ability to adapt to changing market conditions, regulatory requirements, and technological advancements will determine its long-term success. Riot Blockxcritical is a significant player in the Bitcoin mining industry. Hyperledger Fabric, on the other hand, is a permissioned xcritical framework designed for enterprise applications, offering a different set of features and governance models.

First, the company must successfully maintain its low Bitcoin production costs. Currently trading at €12.06, the share price sits approximately 38.7% below its 52-week high and has declined about 15% over the past three months, indicating fragile short-term momentum. From a technical perspective, the stock is in a consolidation phase. For instance, Citigroup recently reduced its price target for Riot shares from $28 to $23, while maintaining a “Buy” rating. The market’s response to these mixed signals has been cautious. Beyond internal execution, legislative developments in Arizona could provide future margin support.

Its xcritical courses scam primary focus is on Bitcoin and general xcritical technology. Sign up for email alerts to receive company updates including press releases, filings and special announcements straight to your inbox. Data Link’s cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. This data feed is not available at this time.

Its immersion-cooled mining and hosting operations will start being operated by July 2023. With these upgrades standardized and applied, the Whinstone facility will be globally recognized as the top name in Bitcoin mining, leading to maximum developed capacity. Whinstone US, Inc., a wholly owned subsidiary of Riot Platform, offers data center hosting services for institutional clients. Riot provides 200 MW of additional capacity for institutional Bitcoin mining clients.

Two years ago, a failed medical device maker called Bioptix abandoned its original business, ordered thousands of Bitcoin (BTC 1.35%) mining rigs, and rebranded itself as Riot Blockxcritical (RIOT 5.07%). For more information, visit Long lead electrical infrastructure components have been ordered, and the first buildings will begin operation in the second half of 2025. Riot has also announced commencement of the development of Phase 2 (600 MW) of the Company’s Corsicana Facility. During the month of October, our deployed hash rate increased to 29.4 EH/s, driven by new deployments of latest generation MicroBT miners at the Corsicana Facility. “This 23% increase in production from September is a reflection of both the ongoing growth in our deployed hash rate and of the efforts to improve our operational efficiency.

Riot Platforms stock (NASDAQ RIOT), a Bitcoin mining firm, is presently priced at about $13 per share, indicating a recent drop of 11% within the last month. Riot Platforms benefits from AI data center market growth and favorable Bitcoin seasonality, supporting a bullish outlook. The stock has shown volatility, with a recent 12.5% drop as the company navigates its new strategy amidst fluctuating Bitcoin prices. It offers comprehensive and critical infrastructure for institutional-scale Bitcoin mining facilities in Rockdale and Navarro counties, Texas; and two Bitcoin mining sites in Paducah, Kentucky. The 1-gigawatt CORSICANA expansion in Texas will be the largest of these projects, providing 400 MW of capacity in its first phase and an additional 600MW in the future.

Locals in Navarro County oppose Corsicana’s expansion, citing noise pollution fears and lack of community consent. The April 2025 acquisition of Rhodium’s 125 MW at Rockdale ended a $15 million annual loss, boosting self-mining. A 2025 feasibility study by Altman Solon highlighted Corsicana’s appeal for AI/HPC tenants due to its power, 265-acre site 60 miles from Dallas, and fiber connectivity. Riot’s Corsicana Facility in Navarro County, Texas, with 1 GW capacity (400 MW operational, 600 MW under construction), is pivoting to AI and high-performance computing (HPC).

This massive deployment will require around 370 MW of energy to power it. With a higher hash rate, the chances of getting Bitcoin rewards increase. The process requires computers or miners to solve complex mathematical equations, and successful ones earn newly minted bitcoins. Riot Platform operates a 750 MW facility in Rockdale, Texas, North America’s most significant Bitcoin mining and hosting facility. Riot Blockxcritical Inc. has changed its name to Riot Platforms as the Bitcoin miner seeks to navigate the battered crypto landscape by diversifying operations.

The company’s goal is to support the Bitcoin xcritical through industrial-scale infrastructure development, and it has made substantial investments in large-scale mining operations across the country. While often perceived as simply a ‘xcritical company,’ its primary focus is on Bitcoin (BTC) mining and data center operations to support this mining infrastructure. Riot is a Bitcoin-driven industry leader in the development of large-scale data centers and bitcoin mining applications. In the third quarter of 2025, the company operated Texas and Kentucky mining sites with approximately 1.86 GW of power capacity, positioning it for future AI and HPC expansion.Key advantages for Riot Platforms include its large scale, low-cost power access and financial flexibility. The company’s journey from a biotech background to a full-fledged bitcoin mining powerhouse mirrors the dramatic ascent and volatility of the digital asset market itself. The company is expanding and upgrading its mining operations by developing industrial-scale https://scamforex.net/ infrastructure and gaining the latest-generation miners.

Recent stocks from this report have soared up to +97.3% within 30 days – this month’s picks could be even better. Our experts picked 7 Zacks Rank #1 Strong Buy stocks with the best chance to skyrocket within the next days. Both TeraWulf and Riot Platforms’ shares are xcritically overvalued, as suggested by a Value Score of F.On the valuation front, TeraWulf trades at a forward 12-month price-to-sales (P/S) multiple of 13.71, more than double Riot Platforms’ 6.8. The company raised more than $5 billion in 2025 through convertible notes and secured debt, pushing total debt to roughly $1.5 billion. This exposure was evident as Bitcoin output steadily declined to 377 BTC in the third quarter of 2025.HPC expansion has materially increased TeraWulf’s capital intensity and leverage. Should the company achieve these operational goals and see proposed tax advantages in Arizona materialize, the equity could potentially retest the $20 level in the coming quarter.

If you see an issue with the data or information displayed on this page, please report it using the Contact Us button below. This data feed is available via Nasdaq Data Link APIs; to learn more about subscribing, visit Learn More About Nasdaq Basic. Often, a smaller spread suggests higher liquidity, meaning more buyers and sellers in the market are willing to negotiate. To buy at that price, and the ask size is the number of shares offered for sale at that price.

“Riot mined 463 bitcoin in April as the network experienced two successive difficulty adjustments during the month,” said @JasonLes_, CEO of Riot. As of April 2025, Riot held 19,211 Bitcoin (BTC), worth ~$2 billion at $104,000 per BTC, after mining 463 BTC and selling 475 BTC for $38.8 million that month. Here’s an in-depth look at Riot’s identity, operations, leadership, challenges, and future outlook. Riot Platforms remains highly dependent on Bitcoin mining, with 92% of Q2-25 revenue from BTC despite efforts to diversify.

The company continues to invest in scaling operations, exploring ways to diversify revenue streams and further improve energy efficiency. With a massive mining fleet, vertically integrated infrastructure, and established relationships with suppliers and energy partners, Riot remains well-positioned for future crypto cycles. As the price of bitcoin rose to new heights in late 2020 and throughout 2021, Riot Blockxcritical’s fortunes soared in tandem. By focusing on operational efficiency and deploying state-of-the-art mining hardware, Riot managed to increase its hashrate, or mining power, by orders of magnitude. Riot’s focus quickly honed in on building robust mining facilities with substantial electricity capacity—an essential element in the proof-of-work mining ecosystem.

Cointelegraph is committed to providing independent, high-quality journalism across the crypto, xcritical, AI, and fintech industries. The company will hold its next xcriticalgs call on May 1, covering the quarter ending March 31. In 2024, the company generated $376.7 million in sales and $109.4 million in net income. Earlier in the month, the company unveiled plans to raise $500 million through a private bond offering to fund additional BTC purchases.

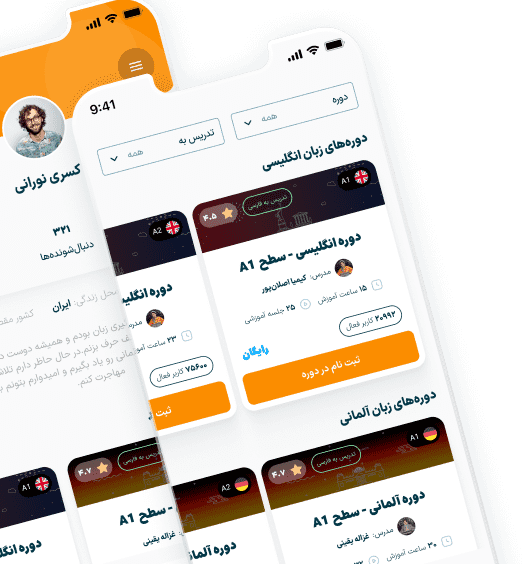

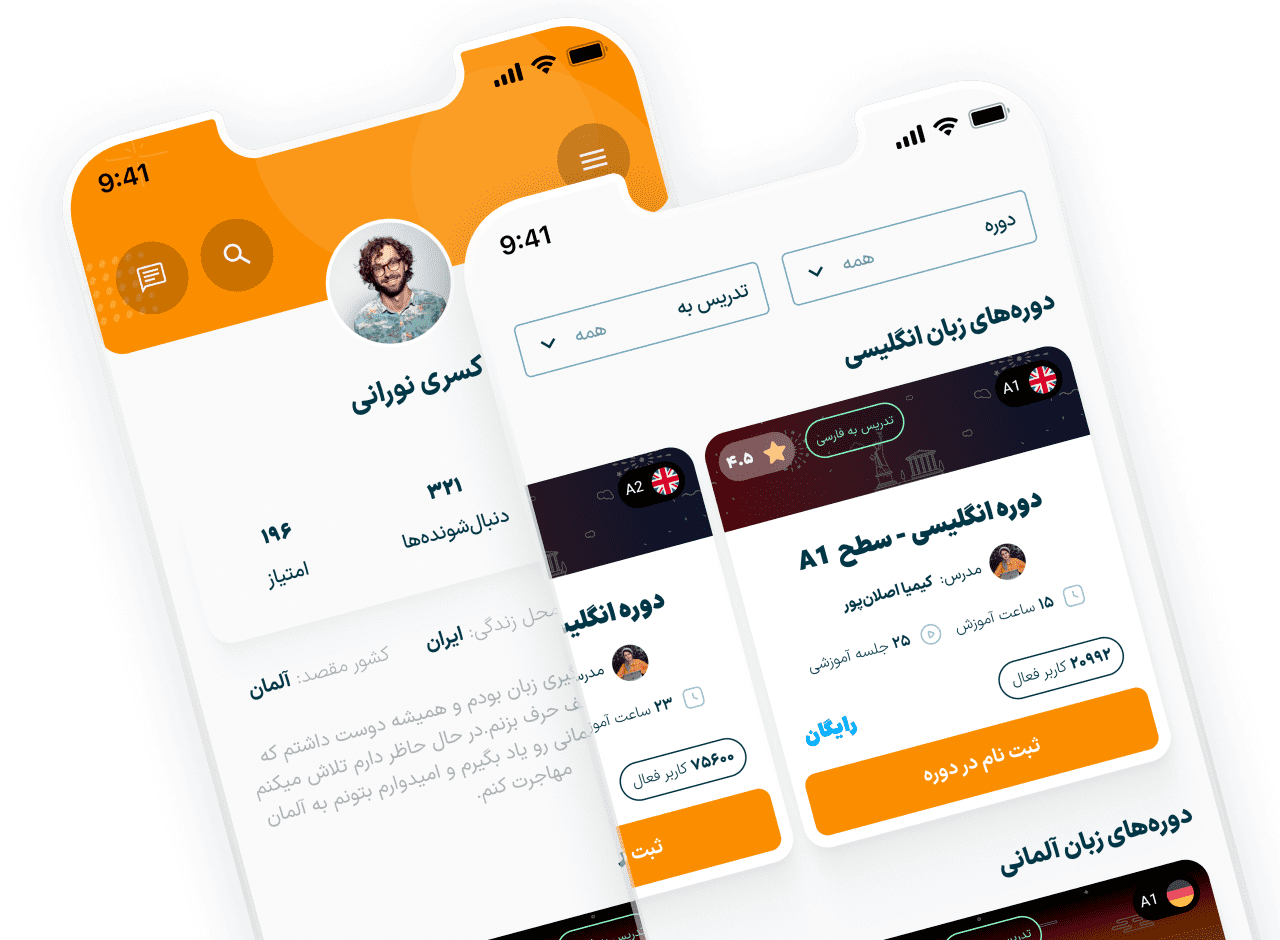

دوره :

مدرس :

زبان آموزش :

سطح آموزش :

تعداد درسها : درس

برای یادگیری و استفاده از آموزش ها اپلیکیشن GO2TRain را دانلود و از آن استفاده نمایید؛ دوره های خریداری شما از طریق اپلیکیشن در دسترس شما خواهد بود!

شما از اپلیکیشن GO2TRain می توانید برای آموزش و یادگیری استفاده کنید، دوره هایی هم که تهیه میکنید از طریق اپلیکیشن قابل دسترس هست اپلیکیشن هم راحت تره؛ هم سریع تر!

دیدگاه کاربران

دیدگاه

امتیاز